nebraska auto sales tax

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. Rates include state county and city taxes.

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

For instance browser extensions make it possible to keep all the tools you need a click away.

. If you are registering a motorboat contact the Nebraska Game and Parks Commission. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. 02003A The tax due shall be computed on the difference between the total sales price and the. With the collaboration between signNow and Chrome easily find its extension in.

This form is read only meaning you cannot print or file it. Advertisements Unlawful 052018 Agricultural Machinery and Equipment Sales Tax Exemption 092020 Animal Specialty Services 082003 Auction Sales 052022 Auto Body Specialists 032004 - contains information updated 122009 Bars Taverns and Restaurants 032007. Nebraska vehicle title and registration resources.

Some localities collect additional local fees and taxes. Under the pre-1998 system motor vehicles were assigned a value by the Tax Commissioner based on average sales price for vehicles of that make age and. The sale state on the sales invoice the dollar amount of the tax and furnish the purchaser a Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6.

2020 rates included for use while preparing your income tax deduction. Questions regarding Vehicle Registration. To remain in Nebraska more than 30 days from the date of.

Contact your County Treasurers office for more information. NE Sales Tax Calculator. Ad Nebraska Sales Tax registration application for new businesses.

In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car. Registration Fees and Taxes. This means that depending on your location within Nebraska the total tax.

A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser. Which county in Nebraska has the lowest tax. Printable PDF Nebraska Sales Tax Datasheet.

Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item. Several counties have only the statewide sales tax rate of 55 without any additional city or county tax. The latest sales tax rates for cities in Nebraska NE state.

Services are generally taxed at the location where the service is provided to the customer. Vehicle Title Registration. For example a 1000 cash rebate may be offered on a 10000 car meaning that the out of pocket cost to the buyer is 9000.

Register the vehicle and pay sales tax. Nebraska auto sales tax formarity due to its number of useful features extensions and integrations. Driver and Vehicle Records.

The Nebraska state sales and use tax rate is 55 055. The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning Jan. Purchase of a 30-day plate by a nonresident of Nebraska who does not intend.

Fast Secure - Florida State Sales Use Tax Application - Nebraska Sales Tax. Deliveries into another state are not subject to Nebraska sales tax. Refer to Sales Tax Regulation 1-006 Retail Sale or Sale at Retail and Local Sales and Use Tax Regulation 9-007 Cities Change or.

49 rows Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales 072022 6. Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832 on top of the state tax. Qualified businessprofessional use to view vehicle.

Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the. The sales tax on a used vehicle in Nebraska is 55 the same as a new car purchase. These cities include Author.

Amended Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Note. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. Nebraska taxes vehicle purchases.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated 09082022 Effective January 1 2023 the village of Byron will start a local sales and use tax. Sales and Use Tax Regulation 1-02202 through 1-02204. Current Local Sales and Use Tax Rates Vehicles Towed from Private PropertyVehicles Left Unattended on Private.

Us Auto Sales Stone Mountain 6252 Memorial Dr Stone Mountain Ga Yelp

Nebraska Sales Tax Guide For Businesses

Sales Tax On Cars And Vehicles In Nebraska

Nebraska Sales Tax Guide For Businesses

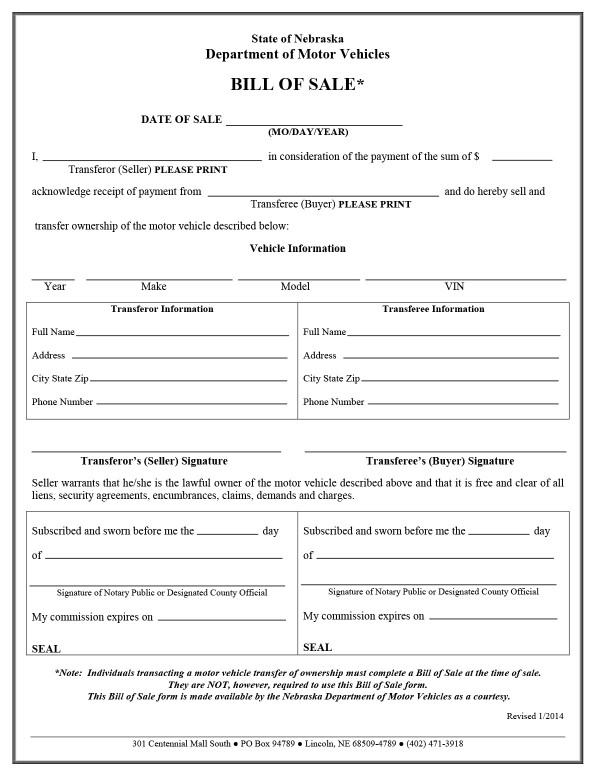

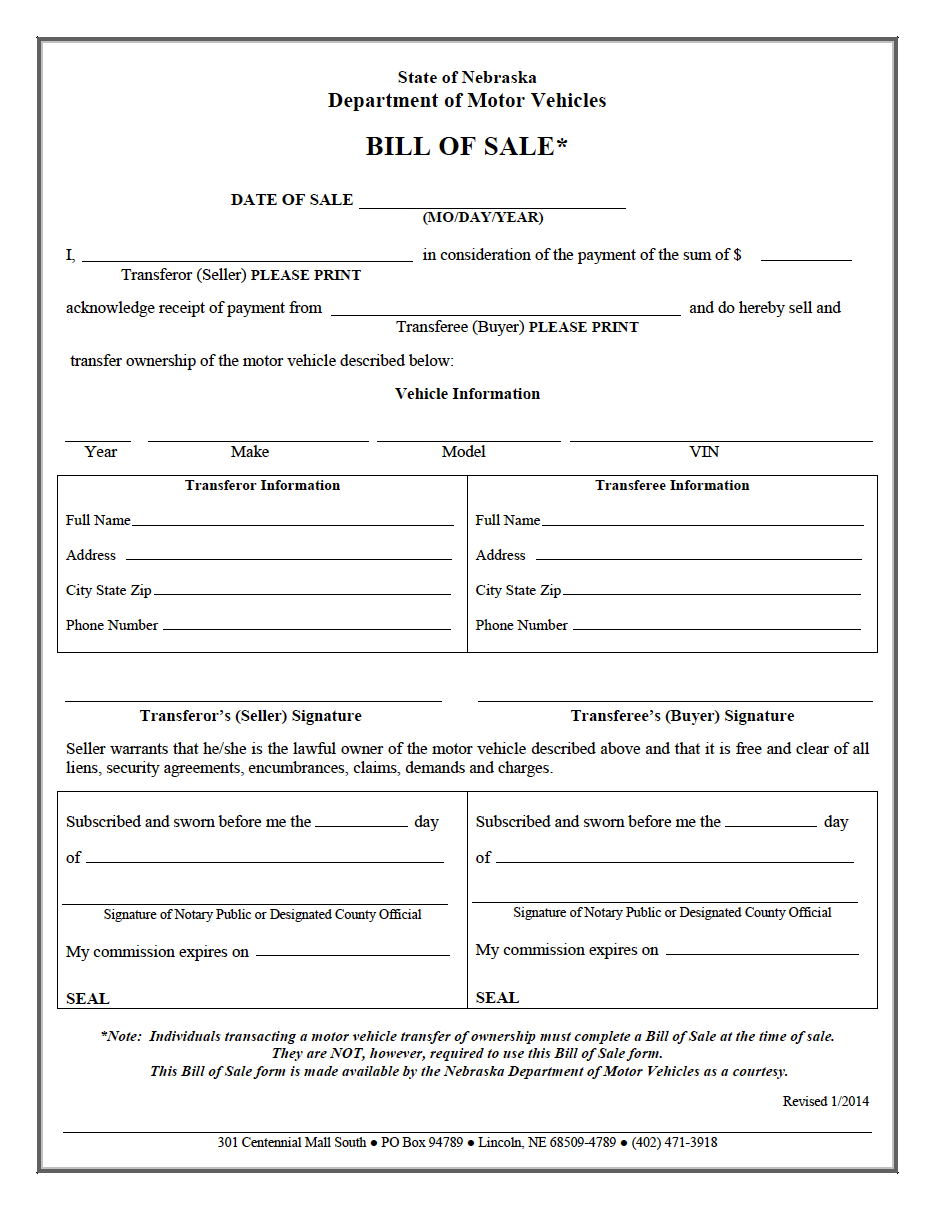

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Eforms

All About Bills Of Sale In Nebraska The Forms And Facts You Need

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Free Nebraska Bill Of Sale Templates Pdf Docx Formswift

Free Nebraska Bill Of Sale Forms 5 Pdf

Nebraska Auto Sales California

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Auto Transmission Omaha Ne Des Moines Ia Kosiski Auto Parts

Free 9 Dmv Bill Of Sale Form Samples In Pdf Ms Word

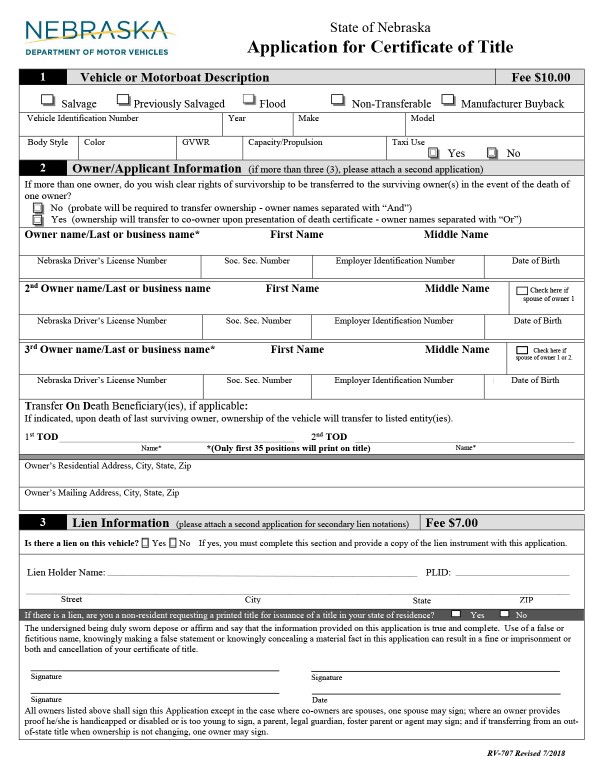

Titles Nebraska Department Of Motor Vehicles

Home Nebraska Auto Sales Sioux City

Nebraska Department Of Revenue

Central Nebraska Auto Sales Car Dealer In York Ne

All About Bills Of Sale In Nebraska The Forms And Facts You Need